UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

| Filed by the Registrant | x |

| Filed by a Party other than the Registrant | o |

Check the appropriate box:

| Preliminary Proxy Statement |

| Confidential, For Use of the Commission Only (as permitted by Rule 14-(e)(2)) |

| x | Definitive Proxy Statement |

| Definitive Additional Materials |

| Soliciting Material Pursuant to Section 240.14a-12 |

American Public Education, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| Fee paid previously with preliminary materials. |

| Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

![[GRAPHIC MISSING]](https://capedge.com/proxy/DEF 14A/0001144204-17-018106/logo_apei-pms.jpg)

AMERICAN PUBLIC EDUCATION, INC.

111 W. Congress Street

Charles Town, West Virginia 25414

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

The 20152017 Annual Meeting of Stockholders of American Public Education, Inc. (the “Company”) will be held on JuneMay 12, 20152017 at 7:30 a.m. local time, at the Gaylord National Resort and Convention Center, 201 Waterfront Street, National Harbor, Maryland 20745, for the following purposes:

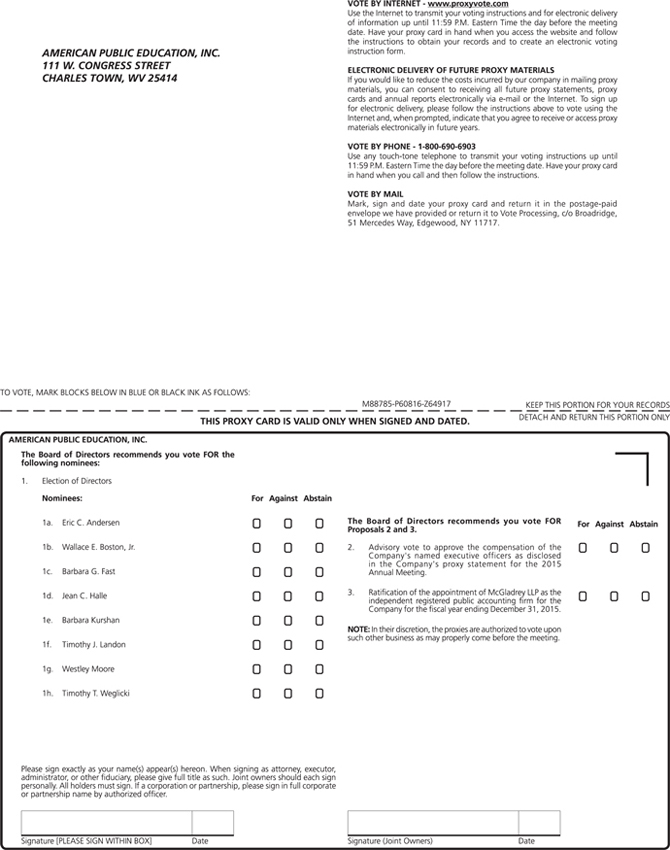

| 1. | to elect the eight nominees for election to the Board of Directors as set forth in the accompanying proxy statement; |

| 2. | to hold an advisory vote on the compensation of our named executive officers as disclosed in our Proxy Statement for the |

| 3. | to hold an advisory vote on the frequency of future advisory votes on the compensation of our named executive officers; |

| 4. | to approve the American Public Education, Inc. 2017 Omnibus Incentive Plan; |

| 5. | to ratify the appointment of |

| to consider any other matters that properly come before the Annual Meeting or any adjournment or postponement thereof. |

Each outstanding share of American Public Education, Inc. common stock (NASDAQ: APEI) entitles the holder of record at the close of business on April 21, 2015,March 17, 2017, to receive notice of and to vote at the Annual Meeting or any adjournment or postponement of the Annual Meeting.

We are pleased to take advantage of Securities and Exchange Commission rules that allow us to furnish our proxy materials and our annual report to stockholders on the Internet. We believe that posting these materials on the Internet enables us to provide stockholders with the information that they need more quickly, while lowering our costs of printing and delivery and reducing the environmental impact of our Annual Meeting.

WHETHER OR NOT YOU EXPECT TO ATTEND THE MEETING, WE URGE YOU TO VOTE YOUR SHARES BY INTERNET, TELEPHONE, OR BY SIGNING, DATING AND RETURNING THE PROXY CARD YOU WILL RECEIVE IF YOU REQUEST PRINTED MATERIALS. IF YOU CHOOSE TO ATTEND THE ANNUAL MEETING, YOU MAY STILL VOTE YOUR SHARES IN PERSON, EVEN THOUGH YOU HAVE PREVIOUSLY VOTED OR RETURNED YOUR PROXY BY ANY OF THE METHODS DESCRIBED IN OUR PROXY STATEMENT. IF YOUR SHARES ARE HELD IN A BANK OR BROKERAGE ACCOUNT, PLEASE REFER TO THE MATERIALS PROVIDED BY YOUR BANK OR BROKER FOR VOTING INSTRUCTIONS.

All stockholders are extended a cordial invitation to attend the meeting.

By Order of the Board of Directors

| |

![[GRAPHIC MISSING]](https://capedge.com/proxy/DEF 14A/0001144204-17-018106/sig_wallace.jpg)

Dr. Wallace E. Boston, Jr.

President and Chief Executive Officer

March 31, 2017

i

| Annex A |

![[GRAPHIC MISSING]](https://capedge.com/proxy/DEF 14A/0001144204-17-018106/logo_apei-pms.jpg)

AMERICAN PUBLIC EDUCATION INC.

111 W. Congress Street

Charles Town, West Virginia 25414

PROXY STATEMENT FOR ANNUAL MEETING OF STOCKHOLDERS

To Be Held On JuneMay 12, 2015

2017

This Proxy Statement (the “Proxy Statement”) and the accompanying proxy are furnished to the stockholders of American Public Education, Inc. (hereinafter, “we,” “us,” “APEI” and the “Company”) in connection with the solicitation of proxies by the Board of Directors (the “Board”), to be voted at the Annual Meeting of Stockholders (the “Annual Meeting”) and at any adjournment or postponement of the Annual Meeting, which will be held at 7:30 a.m. local time on JuneMay 12, 2015,2017, at the Gaylord National Resort and Convention Center, 201 Waterfront Street, National Harbor, Maryland 20745, for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders. The Board has made this Proxy Statement and the accompanying Notice of Annual Meeting available on the Internet.Internet athttp://phx.corporate-ir.net/phoenix.zhtml?c=214618&p=proxy. The Company mailed a Notice of Internet Availability of Proxy Materials to each of the Company’s stockholders entitled to vote at the Annual Meeting on or about April 24, 2015.March 31, 2017.

The purpose of the Annual Meeting is for our stockholders to consider and act upon the proposals described in this Proxy Statement and any other matters that properly come before the Annual Meeting or any adjournment or postponement thereof. In addition, management will report on the performance of the Company and respond to questions from stockholders.

Proposals to be Voted Upon at the Annual Meeting

At the Annual Meeting, our stockholders will be asked to consider and vote upon the following fourfive proposals:

In addition, any other matters that properly come before the Annual Meeting or any adjournment or postponement thereof will be considered. Management is presently aware of no other business to come before the Annual Meeting.

The Board recommends that you vote FOR each of the nominees to the Board (Proposal No. 1); FOR the approval of the compensation of our named executive officers (Proposal No. 2); in favor of holding future executive compensation votes “EVERY YEAR” (Proposal No. 3); “FOR” the approval of the 2017 Omnibus Incentive Plan (Proposal No. 4); and FOR the ratification of the appointment of McGladreyRSM as our independent registered public accounting firm for the fiscal year ending December 31, 20152017 (Proposal No. 3)5).

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting To Be Held on

JuneMay 12, 2015

Pursuant to the “notice and access” rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide stockholders access to our proxy materials over the Internet. Accordingly, we sent a Notice of Internet Availability of Proxy Materials (the “Notice”) on April 24, 2015March 31, 2017 to all of our stockholders as of the close of business on April 21, 2015March 17, 2017 (the “Record Date”). The Notice includes instructions on how to access our proxy materials over the Internet and how to request a printed copy of these materials. In addition, by following the instructions in the Notice, stockholders may request to receive proxy materials in printed form by mail or electronically by e-mail on an ongoing basis.

Choosing to receive your future proxy materials by e-mail will save the Company the cost of printing and mailing documents to you and will reduce the impact of the Company’s annual meetings on the environment. If you choose to receive future proxy materials by e-mail, you will receive an e-mail next year with instructions containing a link to those materials and a link to the proxy voting site. Your election to receive proxy materials by e-mail will remain in effect until you terminate it.

Our Annual Report to Stockholders and this Proxy Statement are available athttp://phx.corporate-ir.net/phoenix.zhtml?c=214618&p=proxy.

Stockholders will be entitled to vote at the Annual Meeting on the basis of each share held of record at the close of business on the Record Date.

If on the Record Date you hold shares of our common stock that are represented by stock certificates or registered directly in your name with our transfer agent, American Stock Transfer & Trust Company (“AST”), you are considered the stockholder of record with respect to those shares, and AST is sending these proxy materials directly to you on our behalf. As a stockholder of record, you may vote in person at the meeting or by proxy. Whether or not you plan to attend the Annual Meeting in person, you may vote over the Internet by following the instructions on the Notice. If you request printed copies of the proxy materials by mail, you may also vote by signing and submitting your proxy card or by submitting your vote by telephone. Whether or not you plan to attend the Annual Meeting, we urge you to vote by way of the Internet, by telephone, or by filling out and returning the proxy card you will receive upon request of printed materials. If you submit a proxy but do not give voting instructions as to how your shares should be voted on a particular proposal at the Annual Meeting, your shares will be voted in accordance with the recommendations of our Board stated in this Proxy Statement. Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by (1) delivering a written notice of revocation addressed to American Public Education, Inc., Attn: Corporate Secretary, 111 W. Congress Street, Charles Town, West Virginia 25414, (2) submitting a duly executed proxy bearing a later date, (3) voting again by Internet or by telephone, or (4) attending the Annual Meeting and voting in person. Your last vote or proxy will be the vote or proxy that is counted. Attendance at the Annual Meeting will not cause your previously granted proxy to be revoked unless you vote or specifically so request.

If on the Record Date you hold shares of our common stock in an account with a brokerage firm, bank, or other nominee, then you are a beneficial owner of the shares and hold such shares in street name, and these proxy materials will be forwarded to you by that organization. As a beneficial owner, you have the right to direct your broker, bank, or other nominee on how to vote the shares held in their account, and the nominee has enclosed or provided voting instructions for you to use in

directing it how to vote your shares. The nominee that holds your shares, however, is considered the stockholder of record for purposes of voting at the Annual Meeting. Because you are not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you bring to the Annual Meeting a letter from your broker, bank or other nominee confirming your beneficial ownership of the shares.

Whether or not you plan to attend the Annual Meeting, we urge you to vote by following the voting instructions provided to you to ensure that your vote is counted.

If you are a beneficial owner and do not vote, and your broker, bank or other nominee does not have discretionary power to vote your shares, your unvoted shares may constitute “broker non-votes.” SharesUnvoted shares that constitute broker non-votes will be counted for the purpose of establishing a quorum at the Annual Meeting. Voting results will be tabulated and certified by the inspector of elections appointed for the Annual Meeting. If you receive more than one Notice, it is because your shares are registered in more than one name or are registered in different accounts. Please follow the instructions on each Notice received to ensure that all of your shares are voted.

A list of stockholders of record as of the Record Date will be available for inspection during ordinary business hours at our offices located at 111 W. Congress Street, Charles Town, West Virginia 25414, from June 1, 2015May 2, 2017 to the date of our Annual Meeting. The list will also be available for inspection at the Annual Meeting.

Quorum Requirement for the Annual Meeting

The presence at the Annual Meeting, whether in person or by valid proxy, of the persons holding a majority of shares of common stock outstanding on the Record Date will constitute a quorum, permitting us to conduct our business at the Annual Meeting. On the Record Date, there were 17,146,41816,219,926 shares of common stock outstanding, held by 460530 stockholders of record. Abstentions (i.e., if you or your broker mark “ABSTAIN” on a proxy) and “broker non-votes” will be considered to be shares present at the meeting for purposes of a quorum. Broker non-votes occur when shares held by a broker for a beneficial owner are not voted with respect to a particular proposal and generally occur because the broker (1) does not receive voting instructions from the beneficial owner and (2) lacks discretionary authority to vote the shares. Brokers and other nominees have discretionary authority to vote on ratification of our independent public accounting firm for clients who have not provided voting instructions. However, without voting instructions from their clients, they cannot vote on “non-routine” proposals, including the election of directors, the authorization of equity compensation plans, and matters related to executive compensation.

Election of Directors. Each director will be elected by the vote of the majority of the votes cast with respect to that director’s election. For purposes of electing directors, a majority of the votes cast means that the number of shares voted “FOR” a director’s election exceeds the number of the votes cast against that director’s election. Abstentions and broker non-votes are not taken into account in determining the outcome of the election of directors.

Advisory vote on executive compensation, approval of the 2017 Omnibus Incentive Plan, and ratification of our independent public accounting firmfirm.. The advisory vote on compensation of our named executive officers, the approval of the 2017 Plan, and the approval of the proposal to ratify the Audit Committee’s appointment of McGladreyRSM as our independent registered public accounting firm for the fiscal year ending December 31, 20152017 each require the affirmative vote of the holders of at least a majority of the shares of common stock present in person or represented by proxy at the Annual Meeting and entitled to vote. Broker non-votes are not taken into account in determining the outcome of these proposals, and abstentions will have the effect of a vote against these proposals.

Frequency of future advisory votes on executive compensation. The proposal on the frequency of future advisory votes on compensation of our named executive officers permits stockholders to select among several alternatives, and it is possible that no one choice will receive a majority vote. A plurality of the votes cast for this proposal will determine the stockholders’ preferred frequency for

holding future advisory votes on executive compensation. This means that whichever of the three options (every year, every two years, or every three years) receives the greatest number of votes will be considered the preferred frequency of the stockholders. Because this vote is merely advisory, the Board will consider but is not bound by its outcomes. While the Board is making a recommendation of every year with respect to this proposal, stockholders are being asked to vote on the choices specified on the proxy card, and not whether they agree or disagree with the Board’s recommendation.

Solicitation of Proxies

We will bear the cost of solicitation of proxies. This includes the charges and expenses of brokerage firms and others for forwarding solicitation material to beneficial owners of our outstanding common stock. We may solicit proxies by mail, personal interview, telephone or via the Internet through our officers, directors and other management employees, who will receive no additional compensation for their services.

CORPORATE GOVERNANCE STANDARDS AND DIRECTOR INDEPENDENCE

The Board has adopted Corporate Governance Guidelines (the “Guidelines”), a Code of Business Conduct and Ethics (the “Code of Ethics”), and a Policy for Related Person Transactions as part of our corporate governance practices and in accordance with rules of the SEC and the listing standards of The NASDAQ Stock Market (“NASDAQ”).

The Guidelines set forth a framework to assist the Board in the exercise of its responsibilities. The Guidelines cover, among other things, the composition and certain functions of the Board, director independence, stock ownership by our non-employee directors, management succession and review, Board committees, the selection of new directors, and director expectations.

The Code of Ethics covers, among other things, compliance with laws, rules and regulations, conflicts of interest, corporate opportunities, confidentiality, protection and proper use of company assets, and the reporting process for any illegal or unethical conduct. The Code of Ethics is applicable to all of our officers, directors and employees. The Code of Ethics includes provisions that are specifically applicable to our Chief Executive Officer, Chief Financial Officer and other Principal Officers (as defined in the Code of Ethics).

Any waiver of the Code of Ethics for our directors, executive officers or Principal Officers may be made only by our Board and will be promptly disclosed as may be required by law, regulation, or rule of the SEC or NASDAQ listing standards. If we amend our Code of Ethics or waive the Code of Ethics with respect to our Chief Executive Officer, Chief Financial Officer or other Principal Officers, we will post the amendment or waiver on our corporate website, which is www.americanpubliceducation.com.www.americanpubliceducation.com. The information on our corporate website is not incorporated by reference into this Proxy Statement.

The Guidelines and Code of Ethics are each available in the Governance section of our corporate website. The Guidelines, Code of Ethics, and Policy for Related Person Transactions are reviewed periodically by our Nominating and Corporate Governance Committee, and changes are recommended to our Board for approval as appropriate.

Certain Relationships and Related Person Transactions

Policies and Procedures for Related Person Transactions

As a supplement to and extension of our Code of Ethics, our Board has adopted a Policy for Related Person Transactions pursuant to which our Nominating and Corporate Governance Committee, another independent committee of our Board or the full Board, must give prior consent before we may enter into a related person transaction with our executive officers, directors, nominees for director and principal stockholders, including their immediate family members and affiliates. Any request for us to enter into a related person transaction with an executive officer, director, nominee for director, principal stockholder or any of such persons’ immediate family members or affiliates must

first be presented to our Nominating and Corporate Governance Committee for review, consideration and approval. A related person transaction is a transaction in which the Company is or will be a participant and in which a related person has or will have a direct or indirect material interest, other than (i) a transaction involving $120,000 or less when aggregated with all related transactions, (ii) a transaction involving compensation to an executive officer that is approved by the Board or the Compensation Committee, (iii) a transaction involving compensation to a director or director nominee that is approved by the Board, the Compensation Committee or the Nominating and Corporate Governance Committee, and (iv) any other transaction that is not required to be reported pursuant to Item 404(a) of Regulation S-K under the Securities Exchange Act of 1934. All of our directors, executive officers and employees are required to report to our Nominating and Corporate Governance Committee any such related person transaction. In approving or rejecting the proposed agreement, our Nominating and Corporate Governance Committee shall consider the facts and circumstances available and deemed relevant to the Nominating and Corporate Governance Committee, including, but not limited to the risks, costs and benefits to us, the terms of the transaction, the availability of other sources for comparable services or

products, and, if applicable, the impact on a director’s independence. Our Nominating and Corporate Governance Committee shall approve only those agreements that, in light of known circumstances, are in, or are not inconsistent with, our best interests, as our Nominating and Corporate Governance Committee determines in the good faith exercise of its discretion. Under the policy, if we should discover related person transactions that have not been approved, the Nominating and Corporate Governance Committee will be notified and will determine the appropriate action, including ratification, rescission or amendment of the transaction.

Related Person Transactions

Carol Gilbert retired from her position as Executive Vice President, Programs and Marketing on December 16, 2016. Ms. Gilbert agreed to consult with the Company after her retirement for a period of 16 months, particularly relating to marketing and enrollment management functions, strategic planning, accreditation, and organizational and realignment matters. In connection with Ms. Gilbert’s retirement, she and the Company entered into a letter agreement dated December 15, 2016 to formalize the terms of her departure. This agreement provides that, as compensation for her consulting services, Ms. Gilbert will receive a fee of $5,000.00 per month and will continue to vest in her outstanding equity awards in accordance with their terms for a 16-month period after her retirement. Such continued vesting was valued at approximately $254,142 as of December 30, 2016 (the last trading day of 2016).

There were no other related person transactions in 2014.2016.

To further align the interest of our executive officers and directors with the interestinterests of our stockholders, and after evaluation of best practices and consultation by the Compensation Committee with Willis Towers Watson & Co.Public Limited Company (“Willis Towers Watson”), its independent consultant, our Board has implemented stock ownership guidelines applicable to our executive officers and directors. Each executive officer is expected to hold shares of common stock with an aggregate value greater than or equal to a multiple of the executive officer’s base salary as set forth below:

Each of the Company’s non-employee directors is expected to hold shares of Common Stockcommon stock with an aggregate value greater than or equal to at least three times the amount of the annual retainer paid to non-employee directors for service on the Board, excluding additional committee retainers, if any.

Under the stock ownership guidelines, common stock held directly, including shares of common stock held in a separate brokerage account or in a 401(k) account, and common stock held indirectly (e.g., by a spouse, minor dependent, or a trust for the benefit of the executive or director, or the executive’s or director’s spouse or minor dependent), count toward satisfaction of the levels set forth in the guidelines. For purposes of the guidelines, the “value” of the common stock is based on the closing price of the common stock on the day on which a determination under the guidelines is being made. The determination of compliance with the guidelines will beis measured annually on the last business day of each year.

Our executives and non-employee directors are expected to comply with these guidelines within five years of the later of March 2, 2011 (the date of adoption of the guidelines) and the date the person first became an executive or non-employee director, as applicable. If an executive officer has not achieved the stock ownership level as outlined above by that date, the executive officer will be required to retain 50% of the net shares of common stock acquired pursuant to restricted stock or optionequity awards made after the adoption of thesethe guidelines until such levels are achieved. “Net shares” are those shares that remain after shares are sold or withheld to pay withholding taxes and/or the exercise price of stock options (if applicable).

The stock ownership guidelines superseded the existing policy applicable to our non-employee directors. That policy provided that directors were expected to hold a number of shares of our common stock equivalent to one-half of all shares of restricted stock they receive.

We have adopted a policy prohibiting our directors, officers and employees from engaging in short sales, transactions in derivative securities (including put and call options), or other forms of hedging and monetization transactions, such as zero-cost collars, equity swaps, exchange funds and forward

sale contracts, that allow the holder to limit or eliminate the risk of a decrease in the value of our securities. We have adopted this policy in order to further align the interests and objectives of individuals subject to the policy with those of our stockholders.

Restrictions on “Pledging”

We have adopted a policy prohibiting our directors and officers from holding our securities in margin accounts, pledging our securities as collateral or maintaining an automatic rebalance feature in savings plans, deferred compensation or deferred fee plans. This prohibition is to avoid sales of our securities on behalf of an individual related to margin calls, loan defaults and employees with our stockholders.automatic rebalances, which may occur when the individual has material nonpublic information regarding the Company.

Board Independence and Leadership Structure

Our Board believes, and our Guidelines require, that a substantial majority of its members should be independent directors. In addition, the respective charters of the Audit, Compensation and Nominating and Corporate Governance Committees currently require that each member of such committees be independent directors. Consistent with NASDAQ’s independence criteria, the Board has affirmatively determined that all of our directors are independent, of the Company and our management, with the exception of Dr. Boston, who is our President and Chief Executive Officer. NASDAQ’s independence criteria includes a series of objective tests, such as that the director is not an employee of the Company and has not engaged in various types of business dealings with us. In addition, as further required by NASDAQ rules, the Board has made a subjective determination as to each independent director that no relationship exists that, in the opinion of the Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, the Board reviewed and discussed information provided by the directors and management with regard to each director’s business and personal activities as they may relate to us and our management.

In accordance with our Guidelines, the independent members of our Board will hold at least two “executive session” meetings each year. If the chairpersonChairperson of the Board is not an independent director, an independent chairperson will be selected for each executive session. In general, these meetings are intended to be used as a forum to discuss the annual evaluation of the Chief Executive Officer’s performance, the annual review of the Chief Executive Officer’s plan for management succession and such other topics as the independent directors deem necessary or appropriate.

Our Guidelines specify that the Board shall select its chairpersonChairperson based on the Board’s determination of what is then in the best interests of the Company. Historically, the Company has split the positions of the Chairperson of the Board and Chief Executive Officer because we believe that this structure is appropriate given the differences between the two roles in our management structure. Our Chief Executive Officer, among other duties, is responsible for settingimplementing the strategic direction for the Company and for the day-to-day leadership and performance of the Company, while the Chairperson of the Board, among other responsibilities, provides guidance to the Chief Executive Officer, and presides over meetings of the full Board.

Board’s Role in Risk Oversight

Our management is responsible for managing risks in our business, including by developing processes to monitor and control risks. The Board views its role as one of oversight and of responsibility for setting a tone that risk management should be properly integrated with our strategy and culture. The Board focuses on understanding management’s risk management processes, the effectiveness of those processes and the way in which management proactively manages risks. The Board regularly meets with our management, particularly our Chief Executive Officer, and Chief Financial Officer as well other executives,and our General Counsel to receive updates on how management is assessing and managing risk in particular functional areas of our business. The Board and its committees also request and receive regular reports from management on particular areas of risk.

The Board is assisted in carrying out its oversight of risks by the Committees. In this regard, each of the charters of the Board’s committees specifically address issues of risk. At the request of the full Board, from time to time the Nominating and Corporate Governance Committee may discuss or examine in more depth specific risk areas and request presentations and information from management for that purpose. The Nominating and Corporate Governance Committee considers and makes recommendations on how the Board is approaching its role of risk oversight. The Audit Committee reviews and assesses the qualitative aspects of financial reporting and our processes to manage financial and financial reporting risk. The Audit Committee regularly reports its findings to the Board.

While the Audit Committee and the Nominating and Corporate Governance Committee have primary responsibility for assisting the Board with its risk oversight responsibilities, the Compensation Committee also assists the Board with risk oversight. When establishing executive compensation and director compensation and in its role in implementing incentive compensation plans, the Compensation Committee considers whether compensation practices properly take into account an appropriate risk-reward relationship or encourage unnecessary and excessive risks that threaten the value of the Company. The Board has concluded, on the recommendation of the Compensation Committee, that the Company’s compensation policies and practices are not reasonably likely to have a material adverse effect on the Company; this conclusion has been confirmed by the Compensation Committee.

Meetings of the Board of Directors and its Committees

Information concerning the Board and its three standing committees is set forth below. Each Board committee currently consists only of directors who are not employees of the Company and who are “independent” as defined in NASDAQ’s rules.

The Board and its committees meet regularly throughout the year, and also hold special meetings and act by written consent from time to time. The Board held a total of eightfive meetings during the fiscal year ended December 31, 2014.2016. During this time all of our directors attended at least 75% of the aggregate number of meetings held by the Board and all committees of the Board on which such director served (during the period that such director served). The Board does not have a formal policy with respect to Board member attendance at annual meetings of stockholders. Our 20142016 Annual Meeting of Stockholders was attended by all of our current directors who were then serving.

The Board has three standing committees: the Audit Committee; the Compensation Committee; and the Nominating and Corporate Governance Committee. The charters for the Audit, Compensation and Nominating and Corporate Governance Committees can be accessed electronically on the Committees page of our corporate website, which is www.americanpubliceducation.com.www.americanpubliceducation.com. The information on our corporate website is not incorporated by reference into this Proxy Statement.

The Board conducts, and the Nominating and Corporate Governance Committee oversees, an annual evaluation of the Board’s operations and performance in order to enhance its effectiveness. Recommendations resulting from this evaluation are made by the Nominating and Corporate Governance Committee to the full Board for its consideration.

BOARD COMMITTEES AND THEIR FUNCTIONS

The following table describes which directors serve on each of the Board’s standing committees.

| Name | Audit Committee | Compensation Committee | Nominating and Committee | |||||||||||||

| Eric C. Andersen | X | X | ||||||||||||||

| Wallace E. Boston, Jr. | ||||||||||||||||

| Barbara G. Fast | X | (1) | X | |||||||||||||

| Jean C. Halle | X | (1) | ||||||||||||||

| Barbara L. Kurshan | X | X | ||||||||||||||

| Timothy J. Landon | X | X | (1) | |||||||||||||

| Westley Moore | X | X | ||||||||||||||

| William G. Robinson, Jr. | X | X | ||||||||||||||

| (1) | Chair of the Committee. |

| (2) |

The Board has established a separately designated standing Audit Committee in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, which met foursix times during 2014.2016. The Audit Committee is responsible, among its other duties and responsibilities, for overseeing our accounting and financial reporting processes, the audits of our financial statements, the qualifications of our independent registered public accounting firm, and the performance of our internal audit function and our independent registered public accounting firm. The Audit Committee reviews and assesses the qualitative aspects of our financial reporting, our processes to manage financial reporting risk, and our compliance with significant applicable legal, ethical and regulatory requirements. The Audit Committee is directly responsible for the appointment, compensation, retention and oversight of our independent registered public accounting firm. The members of our Audit Committee are Ms. Halle, who serves as chair of the Committee, Mr. Andersen, Mr. Landon, and Mr. Weglicki.Dr. Kurshan. Our Board has determined that Ms. Halle and Mr. Andersen are each an “Audit Committee financial expert,” as that term is defined under the SEC rules implementing Section 407 of the Sarbanes-Oxley Act of 2002. Our Board has determined that each member of our Audit Committee is independent under NASDAQ’s listing standards and each member of our Audit Committee is independent pursuant to Rule 10A-3 of the Securities Exchange Act of 1934.

The Compensation Committee is responsible, among its other duties and responsibilities, for establishing the compensation and benefits of our Chief Executive Officer and other executive officers, monitoring compensation arrangements applicable to our Chief Executive Officer and other executive officers in light of their performance, effectiveness and other relevant considerations, and administering our equity incentive plans. The Committee met eightseven times during 2014.2016. The members of our Compensation Committee are MG (Ret) Fast, who serves as chair of the Committee, Mr. Andersen, Mr. Moore, and Mr. Moore.Robinson. Our Board has determined that each member of our Compensation Committee meets NASDAQ’s independence requirements for approval of the compensation of our Chief Executive Officer and other executive officers.

The Compensation Committee has the sole authority to retain and terminate any compensation consultant to assist in evaluating executive officer compensation. In 2014,2016, the Compensation Committee retained Willis Towers Watson directly as an outside compensation consultant to assist in evaluating our compensation programs, as it has since 2007. The Compensation Committee assessed Willis Towers Watson’s independence, considering all relevant factors, including those set forth in NASDAQ rules. In connection with this assessment, the Committee considered Willis Towers Watson’s work and determined that it raised no conflicts of interest. Willis Towers Watson does no

work for the Company other than work that is authorized by the Compensation Committee or its chairperson. The Compensation Committee used information provided to it by Willis Towers Watson in connection with making 20142016 compensation determinations. Willis Towers Watson also advised the Compensation Committee on the use of a peer group for comparative purposes. The consultant’s role in recommending the amount or form of executive compensation paid to the Company’s named executive officers during 20142016 is described in the “Compensation Discussion and Analysis — Compensation Program Philosophy and Objectives — Competitive Compensation and Peer Group Review” section below.

The Compensation Committee considers the results of the annual advisory vote on the compensation of our named executive officers. See “Proposal No. 2” below to review this year’s proposal. In 2013,2016, approximately 89%98% of the stockholder votes cast on this proposal were voted in favor of our executive compensation proposal, which was the most recent shareholder vote before we set our 2014 compensation. The Compensation Committee considered this in the context of the recommendation of various proxy advisory firms and as part of its decision to continue to increase the proportion of compensation that is performance-based. In 2014, approximately 97% of the stockholder votes cast on this proposal were voted in favor of our executive compensation proposal.

The Compensation Committee works closely with our Chief Executive Officer, Dr. Boston, on compensation decisions and has delegated certain aspects of the annual incentive plans for the other executive officers, including the named executive officers, to Dr. Boston. For a discussion of Dr. Boston’s role in determining or recommending the executive compensation paid to the Company’s named executive officers during 2014,2016, see the “Compensation Discussion and Analysis — Role of Executives in Executive Compensation Decisions” section below. None of our other executive officers participates in any deliberations related to the setting of executive compensation with the exception of Peter W. Gibbons, our Senior Vice President, Chief Administrative Officer, who provides administrative support to the Compensation Committee and facilitates the requests for information received from the independent consultant.compensation.

Nominating and Corporate Governance Committee

The Nominating and Corporate Governance Committee is responsible for recommending candidates for election to the Board. The Committee met five times during 2014.2016. The Committee is also responsible, among its other duties and responsibilities, for making recommendations to the Board or otherwise acting with respect to corporate governance policies and practices, including board size and membership qualifications, recommendations with respect to director resignations tendered in the event a director fails to achieve a majority of votes cast in favor of his or her election, new director orientation, committee structure and membership, succession planning for our Chief Executive Officer and other key executive officers, and communications with stockholders. In addition, the Nominating and Corporate Governance Committee assists the Board in understanding and overseeing management’s processes for the assessment and management of non-financial risks of the Company and the steps that management has taken to monitor and control exposure to such risks. The members of our Nominating and Corporate Governance Committee are Mr. Landon, who serves as chair of the Committee, MG (Ret) Fast, Dr. Kurshan, Mr. Moore and Mr. Weglicki.Robinson. Our Board has determined that each member of our Nominating and Corporate Governance Committee meets NASDAQ’s independence requirements for directors that make director nominations.

DIRECTOR NOMINATIONS AND COMMUNICATION WITH DIRECTORS

The Nominating and Corporate Governance Committee recommends, and the Board nominates, candidates to stand for election as directors. Stockholders may also nominate persons to be elected as directors. If a stockholder wishes to nominate a person for election as director, he or she must follow the procedures contained in our Bylaws and satisfy the requirements of Regulation 14A of the Securities Exchange Act of 1934. For a stockholder’s nomination of a person to stand for election as a director at the annual meeting of stockholders to be considered, our Corporate Secretary must receive such nominations at our principal executive offices not more than 120 days, and not less than 90 days, before the anniversary date of the precedingprior year’s annual meeting, except that if the annual meeting is set for a date that is not within 30 days before or 60 days after such anniversary, the nomination must be received no later than the later of the 90th day prior to such annual meeting or the close of business on the tenth day following the notice or public disclosure of the meeting. Each submission must include the following information:

The Board may require any proposed nominee to furnish such other information as it may reasonably require to determine the eligibility of such proposed nominee to serve as one of its directors.

Each director will be elected by the vote of the majority of the votes cast with respect to that director’s election, provided that if, as of the tenth (10th) day preceding the date we first mail notice of the meeting for such meeting to our stockholders, the number of nominees exceeds the number of directors to be elected, which we refer to as a “Contested Election”, the directors shall be elected by the vote of a plurality of the votes cast. Our Bylaws require that the Board or a committee of the Board shall not nominate any incumbent director who, as a condition to such nomination, does not submit a conditional and, in the case of an uncontested election, irrevocable letter of resignation to the Chairperson of the Board. If an incumbent nominee is not elected in an uncontested election, the Nominating and Corporate Governance Committee will promptly consider such director’s conditional resignation and make a recommendation to the Board regarding the resignation. Each incumbent director nominated for election to the Board at the Annual Meeting as described under “Proposal No. 1” below has submitted the conditional letter of resignation as required by our Bylaws.

In the event an incumbent director fails to receive a majority of the votes cast in an election that is not a Contested Election, the Nominating and Corporate Governance Committee, or such other committee designated by the Board pursuant to our Bylaws, shall make a recommendation to the Board as to whether to accept or reject the resignation of such incumbent director, or whether other action should be taken. The Board shall act on the resignation, taking into account the Committee’s

recommendation, and publicly disclose (by a press release and filing an appropriate disclosure with the SEC) its decision regarding the resignation and, if such resignation is rejected, the rationale behind the decision, within ninety (90)90 days following certification of the election results. The Committee in making its recommendation and the Board in making its decision each may consider any factors and other information that it considers appropriate and relevant.

Additional information regarding requirements for stockholder nominations for next year’s annual meeting is described in this Proxy Statement in the section titled “General Matters — Stockholder Proposals and Nominations” below.

Contacting the Board of Directors

Stockholders wishing to communicate with our Board may do so by writing to the Board, the Chairperson of the Board, or the non-employee members of the Board as a group, at:

American Public Education, Inc.

111 W. Congress Street

Charles Town, West Virginia 25414

Attn: Corporate Secretary

Complaints or concerns relating to our accounting, internal accounting controls or auditing matters will be referred to members of the Audit Committee. Other correspondence will be referred to the relevant individual or group. All correspondence is required to prominently display the legend “Board Communication” in order to indicate to the Corporate Secretary that it is a communication subject to our policy and will be received and processed by the Corporate Secretary’s office. Each communication received by the Corporate Secretary will be copied for our files and in most cases will be promptly forwarded to the addressee. The Board has requested that certain items not related to the Board’s duties and responsibilities be excluded from the communicationcommunications so forwarded under the policy. In addition, the Corporate Secretary is not required to forward any communication that the Corporate Secretary, in good faith, determines to be frivolous, unduly hostile, threatening, illegal or similarly unsuitable. However, the Corporate Secretary will maintain a list of each communication subject to this policy that

is not forwarded and, on a quarterly basis, will deliver the list to the Chairperson of the Board. In addition, each communication subject to this policy that is not forwarded because it was determined by the Corporate Secretary to be frivolous shall nevertheless be retained in our files and made available at the request of any member of the Board to whom such communication was addressed.

PROPOSAL NO. 1 — ELECTION OF DIRECTORS

Our Board is currently comprised of eight members. Our nominees for the election of directors at the Annual Meeting include seven independent non-employee directors and our Chief Executive Officer. Each director is elected to serve a one-year term, with all directors subject to annual election. At the recommendation of the Nominating and Corporate Governance Committee, the Board has nominated the following persons to serve as directors for the term beginning at the Annual Meeting on JuneMay 12, 2015:2017: Eric C. Andersen, Dr. Wallace E. Boston, Jr., MG (R) Barbara G. Fast, Jean C. Halle, Dr. Barbara L. Kurshan, Timothy J. Landon, Westley Moore and Timothy T. Weglicki.William G. Robinson, Jr. All of the nominees are currently serving on the Board.

It is intended by the persons named as proxies that proxiesProxies received in response to this solicitation will be voted FOR the election of each nominee named in this section unless otherwise stated in the proxy or in the case of a broker non-vote with respect to the proposal. Proxies submitted for the Annual Meeting can only be voted for those nominees named in this Proxy Statement. If, however, any director nominee is unable or unwilling to serve as a nominee at the time of the Annual Meeting, the persons named as proxies may vote for a substitute nominee designated by the Board, or the Board may reduce the size of the Board. Each nominee has consented to serve as a director if elected, and the Board does not believe that any nominee will be unwilling or unable to serve. Each director will hold office until his or her successor is duly elected and is qualified or until his or her earlier death, resignation or removal.

Criteria for Evaluating Director Nominees

The Board provides strategic direction to the Company and oversees the performance of the Company’s business and management. The Nominating and Corporate Governance Committee periodically identifies and reviews with the Board desired skills and attributes of both individual Board members and the Board overall within the context of current and future needs. The Nominating and Corporate Governance Committee is responsible for developing the general criteria, subject to approval by the full Board, for use in identifying, evaluating and selecting qualified candidates for election or re-election to the Board. The Nominating and Corporate Governance Committee reviews the appropriate skills and characteristics required of directors in the context of the current composition of the Board, our operating requirements and the long-term interests of our stockholders. It may use outside consultants to assist in identifying candidates. Among the characteristics the Committee may consider are the collective knowledge and diversity of professional skills and background, experience in relevant industries, age and geographic background in addition to the qualities of integrity, judgment, acumen, and the time and ability to work professionally and effectively with other Board members and management and make a constructive contribution to the Board. The Committee considers candidates submitted by directors and management, as well as candidates recommended by stockholders, which are evaluated in the same manner as other candidates identified to it. Final approval of director candidates is determined by the full Board.

The Board has determined that all of our director nominees are qualified to serve as directors of the Company.

The name of each nominee for director, their ages as of April 21, 2015,March 17, 2017 and other information about each nominee is shown below. In addition, the biographies of each of the nominees below contain information regarding the experiences, qualifications, attributes or skills that caused the Nominating and Corporate Governance Committee and the Board to determine that the person should serve as a director for the Company.

| Name | Age | Principal Occupation | Director Since | ||||

| Eric C. Andersen | 53 | Partner, Milestone Partners | 2012 | ||||

| Wallace E. Boston, Jr. | 60 | President and Chief Executive Officer of the Company | 2004 | ||||

| Barbara G. Fast | 61 | Senior Vice President, CGI Federal | 2009 | ||||

| Jean C. Halle | 56 | Independent Consultant | 2006 | ||||

| Barbara Kurshan | 66 | Executive Director of Academic Innovation, University of Pennsylvania, Graduate School of Education | 2014 | ||||

| Timothy J. Landon | 52 | Chief Executive Officer, Aggrego, LLC | 2009 | ||||

| Westley Moore | 36 | Independent Consultant | 2013 | ||||

| Timothy T. Weglicki | 63 | Founding Partner of ABS Capital Partners | 2002 | ||||

| Name | Age | Principal Occupation | Director Since | |||

| Eric C. Andersen | 55 | Partner, Peak Equity | 2012 | |||

| Wallace E. Boston, Jr. | 62 | President and Chief Executive Officer of the Company | 2004 | |||

| Barbara G. Fast | 63 | President and Chief Executive Officer, BGF Enterprises LLC | 2009 | |||

| Jean C. Halle | 58 | Independent Consultant | 2006 | |||

| Barbara L. Kurshan | 68 | Executive Director of Academic Innovation, University of Pennsylvania, Graduate School of Education | 2014 | |||

| Timothy J. Landon | 54 | Chief Executive Officer, Aggrego, LLC | 2009 | |||

| Westley Moore | 38 | Chief Executive Officer of BridgeEdU | 2013 | |||

| William G. Robinson, Jr. | 52 | Executive Vice President and Chief Human Resources Officer, Sabre Corporation | 2016 |

Eric C. Andersen has served on our Board since June 2012. Mr. Andersen also serves on the board of NWHW Holdings, Inc. as the APEI representative. Mr. Andersen is a partner with Milestone Partners,Peak Equity, a lower middle market private equity firm that specializes in making control equity investments in established operating businesses.enterprise software companies. Prior to joining Peak, Mr. Andersen was a partner at Milestone Partners, ina private equity firm, from 2011 fromto 2015. From 2006 to 2011 Mr. Andersen served as a Managing Director of private equity firm Silver Lake Partners, before which he worked in the consulting industry with IBM Business Consulting Services (BCS), serving as Managing Partner, Asia Pacific responsible for IBM’s business solutions and business process outsourcing business across Asia Pacific, and Managing Partner, Distribution Sector responsible for IBM’s consulting business in the pharmaceutical, retail, consumer goods and travel/transportation industries. Before working with IBM, Mr. Andersen was a senior partner at PwC Consulting, where he served in a variety of positions. Mr. Andersen currently serves on the board of directors of several private companies.

We believe that Mr. Andersen’s qualifications to serve on our board include his experience as a principal of twoin several private equity firms, as well as his expertise in outsourcing, business processes and international operations.

Dr. Wallace E. Boston, Jr.joined us in September 2002 as Executive Vice President and Chief Financial Officer and, sinceof APUS. From June 2004 hasto July 2016, he served as President, Chief Executive Officer and a member of our Board.the Board of Directors of APEI as well as President and Chief Executive Officer of APUS. In July 2016, Dr. Boston ceased serving as President and Chief Executive Officer of APUS, but continues to hold his position as President, Chief Executive Officer and a member of the Board of Directors of APEI. From August 2001 to April 2002, Dr. Boston served as Chief Financial Officer of Sun Healthcare Group. From July 1998 to May 2001, Dr. Boston served as Chief Operating Officer and, later, President of NeighborCare, Pharmacies.Inc. From February 1993 to May 1998, Dr. Boston served as Vice President —of Finance and later, Senior Vice President of Acquisitions and Development of Manor Healthcare Corporation, now Manor Care, Inc. From November 1985 to December 1992, Dr. Boston served as Chief Financial Officer of Meridian Healthcare. Dr. Boston currently serves on the Board of the Presidents’ Forum of Excelsior College, the Board of Avalere Health LLC, and the Board of Overseers of the University of Pennsylvania Graduate School of Education.

We believe that Dr. Boston’s qualifications to serve on our Board include his service as our Chief Executive Officer since 2004 and his service as our Chief Financial Officer between 2002 and 2004. Dr. Boston’s leadership has been pivotal to the Company in some of our most significant events, including our accreditation by the Higher Learning Commission in 2006, our 2007 initial public offering, the receipt by American Public University System of the 2009 Ralph E. Gomory Award for Quality Online Education, also known as the Sloan-C Award, our reaccreditation in 2011, and our 2013 acquisition of National Education Seminars, Inc., which we refer to as Hondros College of Nursing.

Major General (Retired) Barbara G. Fasthas served on our Board since May 2009, and was appointed Vice-Chairperson of the Board in August 2014.2014 and was appointed Chairperson in June 2015. MG (Ret) Fast also serves as Chairperson of the Board of Directors of the Company’s subsidiary National Education Seminars, Inc., which operates

as Hondros College of Nursing. She hasis the President and CEO of BGF Enterprises LLC. She served as Senior Vice President, Strategic Engagements, CGI Federal, sincefrom June 2014.2014 to September 2016. Prior to that she served as Senior Vice President, Army Defense and Intelligence Programs, CGI Federal, beginning in November 2012. Prior to that she served as Vice President of Operations and Intelligence, CGI Federal, from June 2011. Previously she was the Vice President of Cyber and Information Solutions at The Boeing Company, which she joined in August 2008. MG (Ret) Fast retired from the Army in July 2008 after a 32-year career. Her most recent posts included: Deputy Director, Army Capabilities and Requirements Center, Training and Doctrine Command, from July 2007 until June 2008; Deputy and, later, Commanding General for the United States Army Intelligence Center and Fort Huachuca, Arizona, from August 2004 until June 2007; and Director of Intelligence, Multinational Forces — Iraq (Baghdad, Iraq) from July 2003 until July 2004. MG (Ret) Fast currently serves on the board of directors of several government and private organizations.

We believe that MG (Ret) Fast’s qualifications to serve on our Board include her extensive experience and achievements in the U.S. Military, national and defense intelligence, and cyber security, culminating in over 32 years of military service until her retirement as a Major General, her service as Commanding General of Fort Huachuca, and her current work in industry.

industry and not-for-profit organizations.

Jean C. Hallehas served on our Board since March 2006. Ms. Halle also serves on the board of Second Avenue Software as the APEI representative. Since 2010, Ms. Halle has worked as an independent consultant. From September 2013 until May 2014 she served as the Acting Chief Operating Officer for Curiosityville, a digital early learning company. From 2002 to 2010, Ms. Halle was the Chief Executive Officer of Calvert Education Services, a provider of accredited distance education programs and educational support services. From 1999 to 2001, Ms. Halle was the Chief Financial Officer and Vice President of New Business Development for Times Mirror Interactive, a digital media subsidiary of the former Times Mirror Company. From 1986 to 1999, Ms. Halle held a number of positions with The Baltimore Sun Company, including Vice President of New Business Development, Chief Financial Officer and Vice President of Finance, President of Homestead Publishing, a subsidiary of The Baltimore Sun Company, and Director of Strategic Planning. From 1983 to 1986, Ms. Halle was the Chief Financial Officer and Vice President of Finance for Abell Communications, and Assistant Treasurer of A.S. Abell Company, the former parent company of The Baltimore Sun Company. From 1979 to 1983, Ms. Halle was a Senior Management Consultant with Deloitte, Haskins and Sells, now Deloitte, & Touche, an international accounting and professional services firm.

Ms. Halle currently serves on the President’s Advisory Council for Stevenson University, the Board of Trustees of Catholic Distance University, the Advisory Board of Loyola University School of Education and the advisory boards of two private companies.

We believe that Ms. Halle’s qualifications to serve on our Board include her multifaceted experiences in online education as Chief Executive Officer of Calvert Education Services, in media as Chief Financial Officer and Vice President of New Business Development for Times Mirror Interactive, and in financial consulting as a Senior Management Consultant at an international accounting and professional services firm. Ms. Halle was also a 2011 National Association of Corporate Directors Board Leadership Fellow, having completed a comprehensive program of study for experienced corporate directors spanning leading practices for boards and committees.

Dr. Barbara “Bobbi” L. Kurshan has served on our Board since August 2014, after having been recommended for nomination as a director by Dr. Boston.2014. Dr. Kurshan is the Executive Director of Academic Innovation and a Senior Fellow in Education at the Graduate School of Education at the University of Pennsylvania, a position she has held since 2012. Dr. Kurshan also serves as a consultant ofprovides consulting services through Educorp Consultants Corporation, a company she has owned and operated since 1989. Dr. Kurshan received her MS in Computer Science and her Ed.D. in Curriculum and Instruction with concentration in Educational Technology from Virginia Tech University and has had a nearly thirty-year career as both an academic and award-winning entrepreneur. She currently serves on the board of directors of two private organizations

organizations.

We believe that Dr. Kurshan’s qualifications to serve on our Board include her extensive background and leadership experience for nearly thirty years in the field of higher education.

Timothy J. Landon has served on our Board since January 2009. Since September 2013, Mr. Landon has served as the Chief Executive Officer of Aggrego, LLC, a venture capital-backed startup focused on building content and ad networks for mobile distribution in the United States, Western Europe, the Caribbean, Central America and Asia Pacific. Aggrego’s investors are Wrapports, LLC and Digicel Group Limited. From June 2012 until September of 2013, Mr. Landon served as President of Wrapports Ventures, the venture capital and incubator division of Wrapports, LLC, which disrupts and transforms local media using technology. From 2008 to 2012, Mr. Landon served as Chief Executive Officer of Landon Company, where he focused on early stage angel investing and consulting for private equity, venture capital and large traditional and online media companies. Mr. Landon worked at Tribune Company for more than 20 years, and served in a variety of positions within the Tribune organization, including as President of Tribune Interactive, Inc. from March 2004 until February 2008, where he was responsible for overall interactive and classified advertising strategy, technology and operations for the Tribune Company, and had leadership roles in starting CareerBuilder.com, Classified Ventures (the holding company of apartments.comApartments.com and cars.com)Cars.com), and other online businesses. In December 2008, the Tribune Company filed a voluntary petition for relief under Chapter 11 of the United States Bankruptcy Code.

We believe that Mr. Landon’s qualifications to serve on our Board include his extensive experience in starting, building and managing internet-focused media businesses over the last seventeen years. He brings significant knowledge of online marketing and online business models, including knowledge based on his position as President of Tribune Interactive and his experience at CareerBuilder.com, which has direct relevance and applicability to our business.

Westley Moore has served has served on our Board since June 2013. Since 2014, Mr. Moore’s principal occupation has been as the founder and CEO of BridgeEdU. He is also an author, public speaker and television personality through his wholly owned business entities. WithinIn television, Mr. Moore has been the Executive Producer and host of the PBS miniseries on returning veterans “Coming Back with Wes Moore.” During 2011, he hosted the television program “Beyond Belief” on the Oprah Winfrey Network and served as a news analyst for NBC. Prior to that, in 2010, he published a bestselling book,The Other Wes Moore.Moore. From 2007 to 2011, he was a securities broker with Citigroup. From 2006 to 2007, Mr. Moore worked at the U.S. Department of State as a White House Fellow to Secretary of State Condoleezza Rice. Previously, Mr. Moore served as a paratrooper and Captain in the U.S. Army from 20042005 to 2006, which included a tour of combat duty in Afghanistan.

Mr. Moore currently serves on the board of the Iraq and Afghanistan Veterans of America, the Johns Hopkins University Board of Trustees, and the Valley Forge Military Academy and College Board of Trustees. He is alsoas a trustee of the Baltimore Community Foundation, a member of the Board of Overseers of The Network for Teaching Entrepreneurship, and a trustee fellow of Phi Theta Kappa Foundation.

We believe that Mr. Moore’s qualifications to serve on our Board include his experience in media and communications, as well as his policy and military experience.

Timothy T. WeglickiWilliam G. Robinson, Jr. has served on our Board since August 2002, was appointed Vice-ChairpersonJune 2016. Mr. Robinson is executive vice president and chief human resources officer of the Board in 2010,Sabre Corporation, where he is responsible for leading Sabre’s global human resources organization, including talent management, organizational leadership and was appointed Chairperson of the Board in 2013. Mr. Weglicki is a Founding Partner of ABS Capital Partners, a venture capital firm founded in 1993.culture. Prior to co-founding ABS Capital Partners, from 1978 to 1993,joining Sabre in December 2013, Mr. Weglicki was an investment banker with Alex. Brown & Sons, where he foundedRobinson served as the senior vice president and headed the Capital Markets Group from 1989 to 1993. Mr. Weglicki served on the board of directors and the compensation and the nominating and governance committees ofchief human resources officer at Coventry Health Care, Inc. until itsa diversified managed health care company that then had 14,000 employees, from 2012 to 2013. From 2010 to 2011, Mr. Robinson served as senior vice president for human resources at Outcomes Health Information Solutions, a healthcare analytics and information company specializing in the optimization and acquisition by mergerof medical records. Prior to that, from 1990 to 2010, he worked for General Electric, where he held several human resources leadership roles in 2013diverse industries including information technology, healthcare, energy and is currently onindustrial. Most recently, he was the boardshuman resources leader within the GE Enterprise Solutions division where he led a global team in an organization of directors of several of ABS Capital Partners’ portfolio companies.

20,000 employees in 200 locations worldwide.

We believe that Mr. Weglicki’sRobinson’s qualifications to serve on our Board include his significant experience and leadership of businesses in investment banking, capital marketshuman resources and private equityhis experience as a Founding Partner of ABS Capital Partners, a directoran executive officer of other public companies and head of the Capital Markets Group at Alex. Brown & Sons.companies.

Required Vote and Board Recommendation

In order to be elected as a director, a nominee must be elected by a majority of the votes cast with respect to such nominee at the Annual Meeting. A majority of the votes cast means that the number of shares of common stock voted FOR a nominee must exceed 50% of the votes cast with respect to that nominee. Abstentions and broker non-votes are not taken into account in determining the outcome of the election of directors. Stockholders do not have the right to cumulate their votes in the election of directors. If an incumbent nominee in an uncontested election such as the election to be held at the Annual Meeting fails to be elected, the incumbent nominee will continue in office and the Board will consider whether to accept the nominee’s earlier submitted conditional resignation. If the resignation is not accepted the incumbent nominee may continue in office until a successor is elected.

THE BOARD RECOMMENDS A VOTE FOR ELECTION OF EACH OF THE EIGHT NOMINATED DIRECTORS.

2014 Director Compensation

2016 DIRECTOR COMPENSATIONUnder our non-employee director compensation policy, which was established and is periodically revised following consultation with Willis Towers Watson, directors receive an annual retainer of $40,000. The chairs of the Audit, Compensation, and Nominating and Corporate Governance Committees receive an additional annual retainerretainers of $11,000, $8,500 and $5,500, respectively, the non-employee Chairperson of the Board receives an additional annual retainer of $30,000 and the non-employee Vice-Chairperson of the Board receives an additional annual retainer of $15,000.$30,000. The Chairperson and the Vice-Chairperson areis not entitled to receive any additional annual retainers for also serving as chair of any of the Board’s standing committees.

The annual retainers are payable in quarterly installments, and each director may, before the beginning of the applicable year, elect to receive his or her annual retainer in common stock having the same value as the portion of the annual retainer to be paid, calculated as of the close of business on the first business day of the year. In connection with our annual meeting of stockholders, our non-employee director compensation policy also provides for an annual grant to each director of restricted stock having a value of $55,000 on the grant date. The restricted stock grant vests on the earlier of the one-year anniversary of the date of grant or immediately prior to the next year’s annual meeting of stockholders.

We also reimburse all directors for travel and other necessary business expenses incurred in the performance of their services for us and extend coverage to them under the directors’ and officers’ indemnity insurance policies.

Some directors may also be asked to serve as a representative of our Board on the boards of our wholly-owned subsidiaries or in entities in which we have invested. A non-employee director who serves on the board of a wholly-owned subsidiary as a representative of our Board receives a payment of $2,500 ($3,000 for a director serving as chair) per in-person meeting, or $750 ($1,000 for a director serving as chair) for telephonic meetings, but with no more than one payment per day. Non-employee directors who serve on the board of entities in which we have invested are compensated by those companies consistent with their policies, provided that our Compensation Committee or full Board of Directors reviews the compensation arrangements.

The following table sets forth information regarding compensation earned by our non-employee directors during 2014:2016:

| Name(1) | Fees Earned or Paid in Cash ($)(2) | Stock Awards ($)(3) | Total ($) | ||||||||

| Eric C. Andersen(4) | $ | 40,000 | $ | 54,998 | $ | 94,998 | |||||

| J. Christopher Everett | $ | 19,153 | $ | — | $ | 19,153 | |||||

| Barbara G. Fast | $ | 56,961 | $ | 54,998 | $ | 111,959 | |||||

| Jean C. Halle | $ | 50,061 | $ | 54,998 | $ | 105,059 | |||||

| Barbara Kurshan | $ | 15,561 | $ | 45,949 | $ | 61,510 | |||||

| Timothy J. Landon | $ | 41,503 | $ | 54,998 | $ | 96,500 | |||||

| Westley Moore | $ | 40,000 | $ | 54,998 | $ | 94,998 | |||||

| Timothy T. Weglicki | $ | 57,683 | $ | 54,998 | $ | 112,681 | |||||

| Name(1) | Fees Earned or Paid in Cash ($)(2) | Stock Awards ($)(3) | Total ($) | |||||||||

| Eric C. Andersen(4) | $ | 40,000 | $ | 54,989 | $ | 94,989 | ||||||

| Barbara G. Fast | $ | 83,000 | $ | 54,989 | $ | 137,989 | ||||||

| Jean C. Halle | $ | 51,000 | $ | 54,989 | $ | 105,989 | ||||||

| Barbara L. Kurshan | $ | 40,000 | $ | 54,989 | $ | 94,989 | ||||||

| Timothy J. Landon | $ | 49,967 | $ | 54,989 | $ | 104,956 | ||||||

| Westley Moore | $ | 40,000 | $ | 54,989 | $ | 94,981 | ||||||

| William G. Robinson | $ | 21,538 | $ | 54,989 | $ | 76,527 | ||||||

| (1) | See the Summary Compensation Table in the “Compensation Tables and Disclosures” section of this Proxy Statement for disclosure related to Dr. Boston, who is one of our named executive officers (“NEOs”) as of December 31, |

| (2) | Mr. |

| (3) |

| (4) | Mr. Andersen received an additional |

As of December 31, 2014,2016, there were no exercisable or unexercisable option awards held by our current non-employee directors. The aggregate number of unvested stock awards outstanding held as of that date by our current non-employee directors were as follows:

| Name | Stock Awards | |||

| Eric C. Andersen | 1,983 | |||

| Barbara G. Fast | 1,983 | |||

| Jean C. Halle | 1,983 | |||

| Barbara L. Kurshan | 1,983 | |||

| Timothy J. Landon | 1,983 | |||

| Westley Moore | 1,983 | |||

| 1,983 | ||||

In December 2016, Willis Towers Watson presented to the Compensation Committee information on non-employee director compensation, providing comparative information on the same peer group that the Compensation Committee uses for executive compensation, as well as general industry levels. Following consultation with Willis Towers Watson, the Compensation Committee recommended, and the Board approved, the following increases in director compensation, effective as of January 1, 2017: the annual retainer was increased to $60,000; the annual retainers for the chairs of the Audit, Compensation, and Nominating and Corporate Governance Committees were increased to $15,000, $10,000 and $8,000, respectively; the annual retainer for the non-employee Chairperson of the Board was increased to $50,000; and the grant date value of the annual grant of restricted stock was increased to $75,000. The Board determined that these increases were appropriate because the annual compensation for the Company’s non-employee directors was near the bottom of the peer group and below the median of the general industry survey prepared by Willis Towers Watson. The Board also considered that there had not been any increases to director compensation for three years.

Compensation Discussion and Analysis

| EXECUTIVE SUMMARY | ||

This Compensation Discussion and Analysis describes our executive compensation program and decisions for 2014.2016. This section details the compensation framework applied by the Compensation Committee and, in particular, our compensation philosophy and objectives, elements of compensation, compensation decisions and the link between executive pay and performance. The named executive officers, or NEOs, for 20142016 are:

On June 20, 2016, Mr. Gibbons retired from his position as Senior Vice President and Chief Administrative Officer, remaining with the Company in a non-executive officer capacity as Senior Vice President, Special Projects. On December 16, 2016, Ms. Gilbert retired from her position as Executive OfficerVice President, Programs and Marketing, and agreed to consult with the Company for a period of 16 months.

For 2016, based on our earnings per share (the financial performance metric used in the annual incentive cash compensation plan), payouts under our annual incentive plan were between threshold and target, with our CEO receiving an award at threshold, and, based on our free cash flow (the performance measure for the performance-based deferred stock unit awards), performance awards were earned at the 111% level.

Building on a Strong Foundation

APEI provides online and on-campus postsecondary education through two subsidiary institutions. APUS provides online postsecondary education to approximately 88,700 adult learners and has a history of serving the needs of the military and public safety communities. National Education Seminars, Inc., which we refer to as Hondros College of Nursing,

Building on a Strong Foundation

APEI’s American Public University System (APUS) was founded to provide military and public service communities with access to affordable, quality academic programs, and in 2013 APEI acquired Hondros College of Nursing (HCON), which educates nurses at four Ohioapproximately 1,300 students across five campuses and online. Today, APUS serves over 111,000 students and is one of the largest accredited online providers of higher education in the United States,State of Ohio, as well as online.

Particularly at APUS, we faced a number of challenges in 2016 recruiting students, including challenges associated with increased competition from both traditional and HCON serves approximately 1,500 students. In early 2015, APUS was rankedonline universities, changes in our marketing approach, and our admissions assessment, as well as continued uncertainty in the top 10% among onlinemilitary’s Voluntary Education Program. As a result, net course registrations for APUS declined 8% year-over-year for 2016. Despite these and other challenges, the first course pass and completion rate of undergraduate degree programs byU.S. News & World Report.students using Federal Student Aid at APUS increased approximately 19% in the fourth quarter of 2016 compared to the prior year period. We believe this year-over-year improvement is an indicator that our efforts to attract and retain students with greater college readiness are working, and this directly reflects the leadership of our named executive officers.

As we help our students prepare to advance their careers, APEI is committed to remaining successful amidstduring a period of growing competition and the challenges of the current economic environment.in for-profit education. We continue to focus on driving improvements in our core services — focusing on academic quality, student outcomes, and the learning experience — not only to potentially reach more students and improve our business results, but also to enroll students with greater college readiness and help them achieve success.

In 2014, APUS again was recognized with an Effective Practice Award from the Online Learning Consortium, which Strong and motivated leadership is a professional organization devoted to advancing quality in and expanding access to post-secondary online learning. This is the fourth effective practice award that APUS has received — the most any institution has received recognizing their contributions to improving the quality of online higher education.We remain committed to affordability — despite recently announcing a tuition increase for APUS undergraduates for the first time in 13 years, our combined tuition, fees and books after the tuition increase remain approximately 17% less for undergraduate students than the published average in-state tuition, fees and book costs at public universities, according to the College Board 2014 Trends in College Pricing. The increase in tuition was implemented primarily to support our continued investment in programs, systems and classroom innovation.